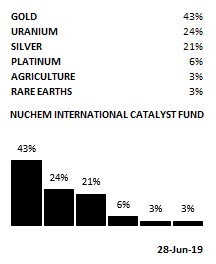

In Q2, we reduced our exposure to uranium and increased our exposure to gold, silver and agriculture; our allocations to platinum and rare earths remain unchanged.

At Fahy Capital Management, our investment decisions are based upon quantitative data. Analysis of that data enables us to execute in what we perceive to be a timely and prudent manner. When our data suggest the gap between price and value has closed, we sell. This approach ensures that we do not fall in love with a particular idea or stock. We perceive stocks as inventory and we like to see that inventory get worked off.

Over the course of a 12-month time frame, we typically expect inventory to be reduced by as many as 2 or 3 names, and this has proven a rate that allows us to reinvest and grow.

New Directions

We remain committed to the value proposition, but how we arrive at determinations of value is changing. We have developed new formulas and new ratios that we believe better reveal the merits and shortcomings of businesses under investigation, while conferring to us an edge on the hairy margins.

We are looking forward to sharing some of our results here in our blog. Those results, however, don’t constitute a recommendation to buy or sell; it’s just food-for-thought.