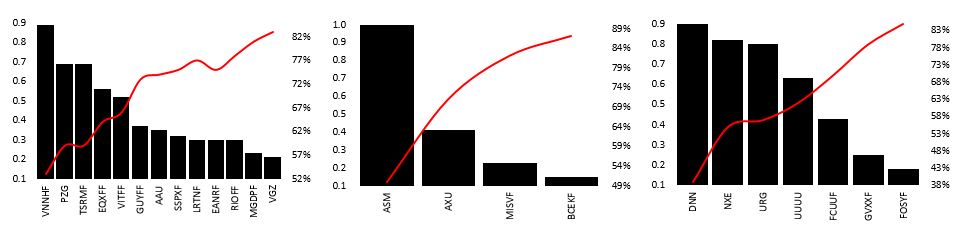

For stocks under study, Absolute Cost Structures (ACS) above 70% are associated with rapid falloffs in MTQ Scores and low MTQ Scores are predictors of low Net Profit Margins.

We will be monitoring stock price performance of a basket* of stocks over the next 24 months in order to establish whether or not there is a statistically significant correlation between price performance and MTQ Scores.

If we are able to ascertain that MTQ Scores serve as predictors of price performance, those scores will become cornerstones of our stock selection process.

*Fahy Capital Management does not necessarily own shares of the stocks under study.