| Long-Term Price Case | $65/lb. U308 | $65/lb. U308 |

| Flagship Project | Phoenix | Gryphon |

| Project Percentage | 90% | 90% |

| Mineral Reserves | 98,460,000 lbs. | 98,460,000 lbs. |

| Shares Outstanding | 589,100,000 | 589,100,000 |

| Market Cap | $342,267,100 | $342,267,100 |

| Average Annual Production | 5.966M lbs. | 7.648M lbs. |

| Recovery | 98.5% | 98.2% |

| LoM | 10 Years | 7 Years |

| Payable Product | 58.767M lbs. | 48.817M lbs. |

| True All-in Cost (TAIC) | $39.20/lb. | $47.83/lb. |

| Gross Revenue | $3,819,855,000 | $3,173,105,000 |

| Saskatchewan Revenue Royalties & Surcharges + Resource Credit | ($276,939,487) | ($230,050,112) |

| Total Operating Cost | ($194,347,597) | ($567,610,551) |

| Operating Profit | $3,348,567,916 | $2,375,444,337 |

| Saskatchewan Profit Royalties | ($502,285,187) | ($356,316,651) |

| Income Taxes | ($904,113,337) | ($641,369,971) |

| Total Capital Costs | ($425,950,000) | ($539,660,498) |

| Net Income (Denison Share) | $1,364,597,453 | $754,287,495 |

| Net Profit Margin | 36% | 24% |

| Absolute Cost Structure (ACS) | 60% | 74% |

| MTQ Score (Higher is Better) | 0.6 | 0.3 |

| True Value | $3.60/sh. | |

| True Value Discount (TVD) | 86% | |

| Phoenix | Gryphon | |

| Cash Flow Multiple | 10x | 5x |

| Net Annual Cash Flow | $138,530,520 | $118,184,544 |

| Future Market Cap Contribution | $1,385,305,200 | $590,922,720 |

| Total Future Market Cap Growth | 477% | |

| Target | $3.35/sh. |

Notes: All Values in U.S. Dollars

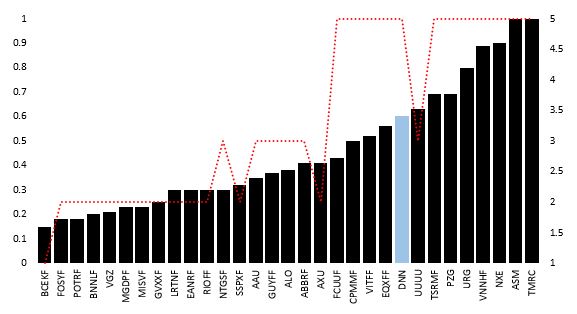

We boosted our stake in Denison Mines this morning by 25% following an updated analysis in which the company achieved a maximum in-house Composite Rating of 5. Denison Mines excelled in the following categories: Net Profit Margin (Phoenix), Absolute Cost Structure (Phoenix), True Value Discount, and Market Cap Growth. Our Target, however, has been lowered by 20%, as our updated calculations implied a True All-In Cost (TAIC) that was higher than expected for Phoenix, while Net Profit Margin and Absolute Cost Structure for Gryphon were average.

MTQ Scores & Composite Ratings — Study Group Comparison

1 Comment

Thank You Tom!

On the U tweeter community we very much miss all your insights…. I´ll try to keep track of your analysis looking at your blog. Thanks again for sharing it!!.

Quick question: Do you think that the ISR technique will work for DNN?…and If so, how will the numbers be?…Should you decide to share them, I´ll be most grateful