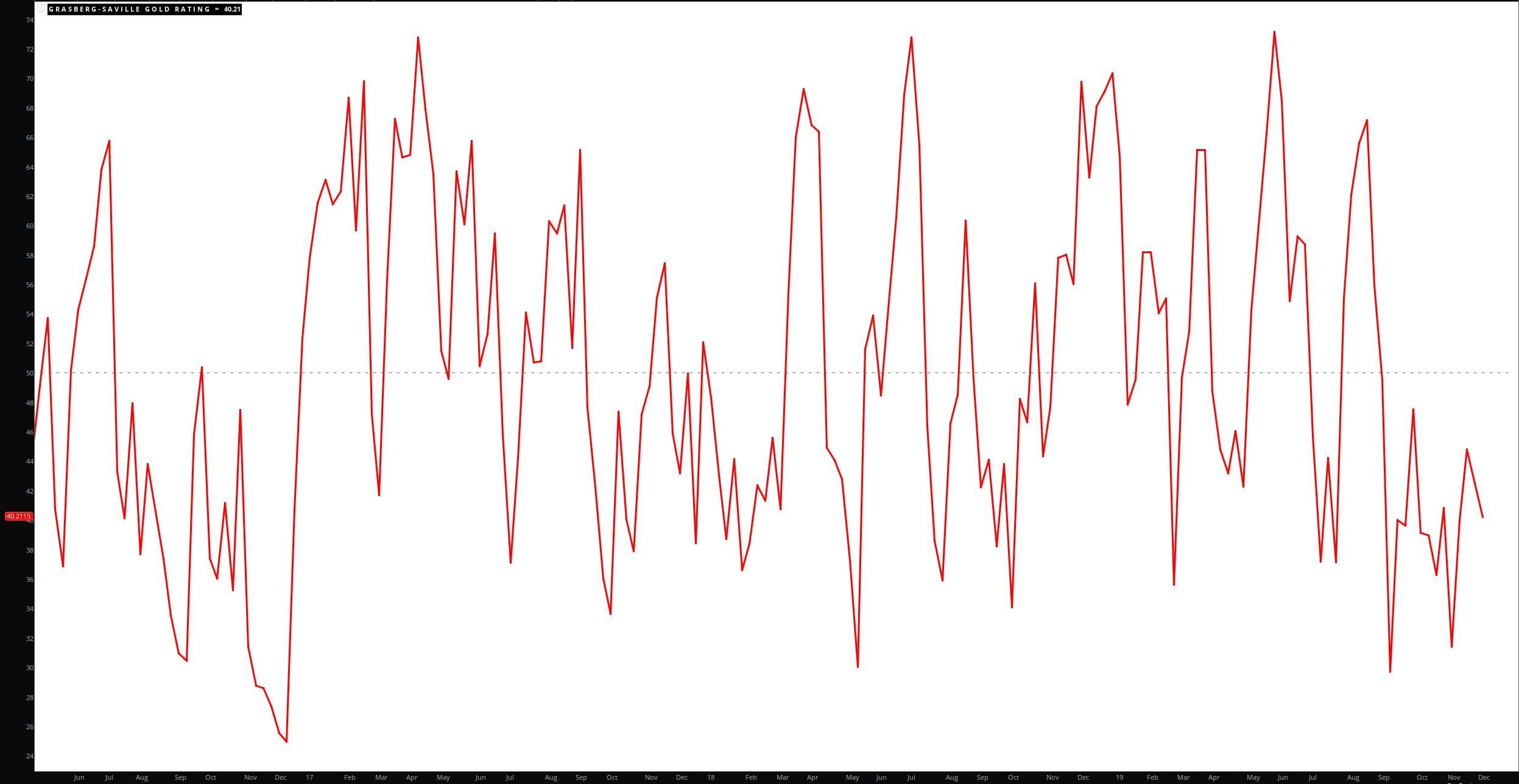

The Grasberg-Saville Gold Rating remains firmly ensconced in bear territory this week. This is the Rating’s 13th such week signalling persistent bearish fundamentals for gold.

Although TIPS continue to consolidate above support, the KBW Bank Index Inverse Change Ratio continues to plummet, with the underlying Index rocketing northward for the second month above the key 104.43 breakout level. The 30s/Dollar Ratio and the 30s/5s Yield Curve Change Ratio also are under pressure.

We are paying particular attention to the KBW Bank Index ($BKX). It is set to open 2020 with a bullish bias in price-neutral territory. If it continues to rise, we expect selling at 117.36, which should afford gold a bit of relief. Selling could also hit the Index well-ahead of 2020 initial resistance, which also would bode well for gold.