| Long-Term Price Case | $65/lb. U308 |

| Flagship Project | Rook I |

| Ownership | 100% |

| Mineral Reserves | 234.1 Mlbs. |

| Shares Outstanding | 372,210,000 |

| Market Cap | $495,039,300 |

| Average Annual Production | 25.4M lbs. |

| Recovery | 97.6% |

| Payable Product | 228.4M lbs. |

| LoM | 9 Years |

| True All-in Cost (TAIC) | $34.69/lb. |

| Gross Revenue | $14,846,000,000 |

| Transportation Costs | ($58,664,379) |

| Provincial Revenue Royalties | ($1,076,335,000) |

| Net Revenue | $13,711,000,621 |

| Total Operating Costs | ($1,015,956,897) |

| Provincial Profit Royalties | ($1,645,320,075) |

| Operating Cash Flow | ($11,049,723,649) |

| Income Taxes (27%) | ($2,983,425,385) |

| Total Capital Costs | ($1,143,580,221) |

| Net Income (LoM) | $6,922,718,043 |

| Net Profit Margin | 47% |

| Absolute Cost Structure (ACS) | 53% |

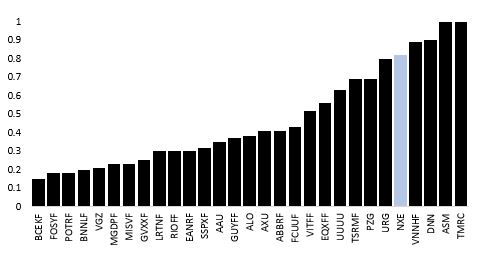

| MTQ Score (Higher is Better) | 0.9 |

| True Value | $18.60/sh. |

| True Value Discount (TVD) | 92% |

| Cash Flow Multiple | 10x |

| Annual Cash Flow | $769,874,000 |

| Future Market Cap | $7,698,740,000 |

| Future Market Cap Growth | 1,261% |

| Target | $20.68/sh. |

Notes: All Values in U.S. Dollars

We are steady buyers of NexGen Energy on weakness and believe it represents the single best, liquid opportunity in the market whereby which to capitalize upon a future bull market in uranium.

NexGen Energy is the only development-stage uranium company with a projected Net Profit Margin approaching 50%. It also has a peer-crushing Absolute Cost Structure of 53%. Both of these already respectable values will improve at higher spot uranium prices.

MTQ Score — Global Study Group Comparison (Higher is Better)