| Long-Term Price Case | $1,700/oz. Au |

| Project | Fenix (Cerro Maricunga[OLD]) |

| Mineral Reserves | 3,743,000 ozs. |

| Shares Outstanding | 118,239,464 |

| Market Cap | $38,427,826 |

| Average Annual Production | 227,895 ozs. |

| Recovery | 79.2% |

| LoM | 13 Years |

| Payable Product | 2,962,630 ozs. |

| True All-in Cost (TAIC) | $1,333/oz. |

| Gross Revenue | $5,036,471,000 |

| Royalties | ($251,823,550) |

| Gross Income | $4,784,647,450 |

| Total Operating Cost | ($2,748,135,588) |

| Operating Profit | $2,036,511,862 |

| Income Taxes | ($549,858,203) |

| Total Capital Costs | ($398,900,000) |

| Net Income | $1,087,753,659 |

| Net Profit Margin | 22% |

| Absolute Cost Structure (ACS) | 78% |

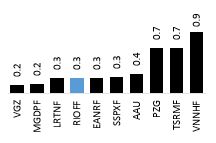

| MTQ Score | 0.3 |

| True Value | $9.20/sh. |

| Cash Flow Multiple | 5x |

| Annual Cash Flow | $83,637,465 |

| Future Market Cap | $418,187,325 |

| Future Market Cap Growth | 988% |

| Target | $3.54/sh. |

Notes: All Values in U.S. Dollars

The Fenix Project is on the high end of the TAIC curve. It will need higher gold prices to be viable. Above $1,700, Net Profit Margin becomes sustainable. It is important to note that social investment costs will be much higher than envisioned by Atacama Pacific and that will have a further deleterious impact on margins, as has the 35% increase in Chilean Corporate Taxes since 2014.

MTQ Score Comparison