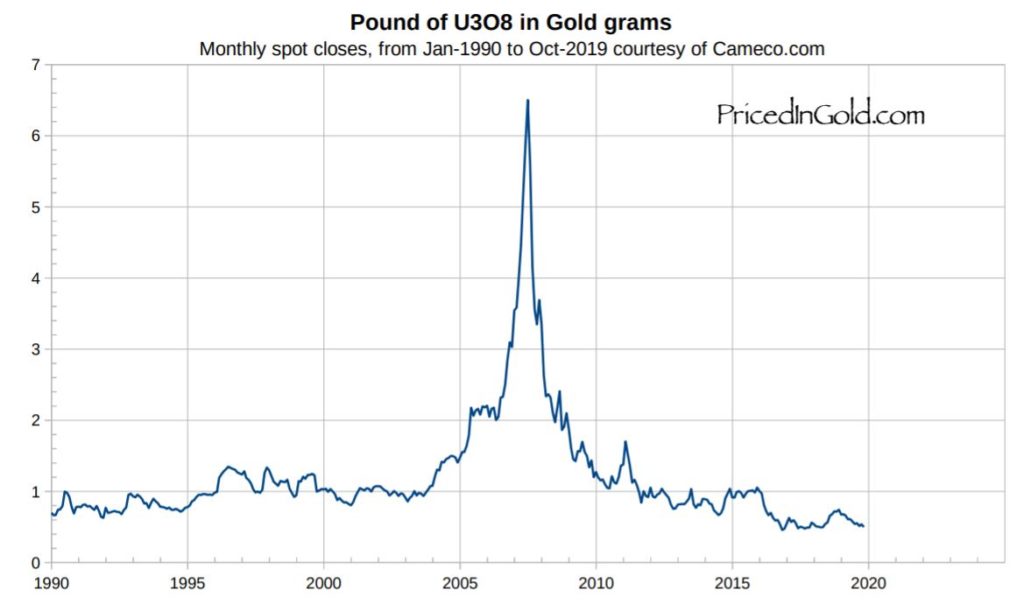

As of this writing, 1/2 g of gold will buy you 1 lb. of U308.

Here’s an edifying chart, compliments of PRICEDINGOLD.COM

Relative to its price in gold grams, spot U308 is revisiting decadal lows.

I don’t often share my thoughts about uranium, but I did so recently in an email to @uraniuminsider. I will reproduce them here, with a couple of minor elaborations. As usual, this is just my opinion.

Undercutting remains the rule of the day, due to broad adherence to the ‘Open Society’/closed economic model (latter day thalassocratic) that operates under the guise of ‘increasing proliferation resistance’ in political theater parlance, but in actuality aims chiefly to annihilate smaller producers (primary & secondary). A side effect is an abandonment of market price discipline — a sacrifice considered an acceptable cost of the non-proliferation cover story.

‘Open Society’ (read: Closed & Rapine) adherents would have the casual spectator assume the strategy is aimed at a boogeyman, like Iran, Pakistan or North Korea, but is in fact squarely directed at nation states that have historically proliferated (prospered) under high-price regimes: U.S., U.K., France, Japan (quietly), and Israel.

I assume a general shift of the balance of power eastward into effective geographic nebulosity was the primary objective, by way of a return to predatory, super-scale, centrifugal hegemony in perpetuity, in spite of, and often in service of, a low-price regime in an undisciplined market. Consequently, as profit is of secondary importance to the latter day thalassocratic merchant class with supplemental income sufficient to offset the thinnest of operating margins, the prospects for primary producers is dimmer now than at any time in the past half century.*

In addition, it is my assumption that secondary supplies are deeper than is commonly assumed. I also am of the opinion that gray munitions and HEU stockpiles have been cannibalized by enrichers, and this under-the-table supply has contributed to a protracted low-price regime. There is no way to accurately calculate the size of the gray market, but I think it is safe to assume that it is quite large. Additionally, M.A.D. is passé and headline numbers of nuclear weapons stockpiles only need to live in tables and graphs in the media, not in actuality.

So an undisclosed stockpile of weapons-grade HEU (some possibly repatriated) slated for downblending at Y-12 and elsewhere has to be worked through before we experience a contraction in the secondary market and a renewed interest by financiers in the primary market, and then only in regions where human capital may be exploited cheaply.

I used the word ‘rapine’ above, as our thalassocratic overlords are first and foremost merchants with a penchant for fluid inventory that is the outcome of endeavors with exceptionally low capital intensity: they are pirates. Much like the Ignatians of yesteryear, today’s merchants operate by way of advanced legerdemain and crypsis, rather than through primary productive enterprise, which necessarily requires that labor is interacted with — their worst nightmare.

So we must wait for a catalyst, which in this context is likely an unforeseen crisis driven by an exotic economic force multiplier — something large enough to waylay the Ignatians for a handful of quarters, raising the cost of fraud.

*Which is why I am a buyer.

The dialog with my buddy @uraniuminsider has continued and it has afforded me an opportunity to expound a bit more.

On Iran and Sanction Waivers

I never put much stock in Fordow, as it had a tiny array of centrifuges. I tend to interpret elimination of waivers as a green-light to take additional enrichment capacity underground at Natanz, which enables Iran to function as a de facto black enrichment subsidiary of Russia, China and others. And one might venture to say that Iran is a chief source of EUP continually hitting spot.

On Iran, generally speaking…

Iran, in my book, has a very special place on the Grand Chessboard, extending back to the Komnene house, and our present political actors today and in the past have had simple instructions: never pierce the veil. Or to riff on a line of intelligence asset Arthur C. Clarke: “All of these worlds are yours, except ‘Iran.’” I don’t mean to suggest that only Iran falls under a unique exclusion policy, but that of those regional entities that fall under such an umbrella, Iran is of particular importance.

On Catalysts

I don’t expect a catalyst to originate in Iran. But the Komnene Empire has its own enemies, and they certainly could script and foment a ‘situation’ designed to place pressure on Komnene interests; a situation with the capacity to uncap competitive productive enterprise until the conclusion of what would prove an internecine conflict.

Final Thoughts

We investors are always caught in the middle of these age-old conflicts. Our present conflict is a protracted one, and as in the past, financial weapons have been deployed after a spectacular fashion hitherto unheard of. Hence, internecine conflict: no one will emerge unscathed from the aftermath of this hubris; the winner will be the side less injured than the other.

So I envision a short interruption (if not complete cessation) of gray market activity accompanying a general market crash and a concomitant resumption of commodities-specific primary production, to our benefit, but certainly not in a long-term, sustainable way.

I see precious few business leaders other than Borshoff taking advantage of the downturn to refine their business models and mine plans in a way that will leverage a sudden resumption of demand. Plans remain too complex relative to envisioned scale. The winner will develop a very large mine rapidly, utilizing off-the-shelf technology. I think Borshoff will prove capable of doing this at 300ppm.