| Long-Term Price Case | $645/t K2SO4 |

| Flagship Project | Sevier Playa |

| Ownership | 100% |

| Mineral Reserves | 7,734,000 tonnes |

| Shares Outstanding | 348,594,751 |

| Market Cap | $40,785,586 |

| Average Annual Production | 205,700 tonnes |

| Recovery | 80% |

| Payable Product | 6,171,000 tonnes |

| LoM | 30 Years |

| True All-in Cost (TAIC) | $424/t |

| Gross Revenue | $3,980,295,000 |

| Royalties | ($222,896,520) |

| Net Revenue | $3,757,398,480 |

| Total Operating Costs | ($1,372,677,240) |

| Operating Cash Flow | $2,384,721,240 |

| Income Taxes | ($372,016,513) |

| Total Capital Costs | ($646,489,167) |

| Net Income | $1,366,215,560 |

| Net Profit Margin | 34% |

| Absolute Cost Structure (ACS) | 66% |

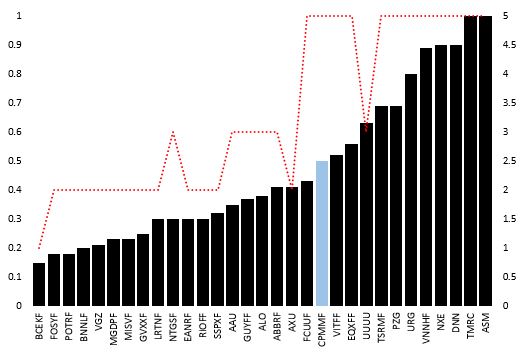

| MTQ Score (Higher is Better) | 0.5 |

| True Value | $3.92/sh. |

| True Value Discount (TVD) | 97% |

| Cash Flow Multiple | 10x |

| Net Annual Cash Flow | $45,459,700 |

| Future Market Cap | $454,597,000 |

| Future Market Cap Growth | 1,015% |

| Target | $1.30/sh. |

Notes: All Values in U.S. Dollars

Crystal Peak Minerals is a top-rated stock with an MTQ Score (0.5) that is above average and a Composite Rating of 5 (Scale of 1-5).

Above $600/t K2SO4, Crystal Peak Minerals will enjoy both a Net Profit Margin > 30% and an Absolute Cost Structure below 70%.

MTQ Score (+ Composite Rating [Red Dotted Line]) — Study Group Comparison